Effective Strategies for Maximizing Cost Savings in Business

1. Conduct a Comprehensive Expense Analysis

Identify and Categorize Expenses

To effectively manage and reduce costs, it is crucial to conduct a detailed analysis of all business expenses. Begin by categorizing expenses into fixed and variable costs. Fixed expenses, such as rent and salaries, remain constant regardless of business activity, while variable costs, like materials and utilities, can fluctuate. By understanding these categories, businesses can better identify which costs can be adjusted or eliminated.

Furthermore, it can be beneficial to break down expenses into more granular subsets, such as operational, administrative, and marketing costs. This detailed categorization allows for a clearer understanding of where money is spent and highlights areas ripe for cost-saving opportunities. For example, a company may find that its marketing expenses could be optimized by shifting to more cost-effective digital advertising methods.

Benchmark Against Industry Standards

In addition to internal analysis, it's important to compare your expense data against industry benchmarks. This can help identify areas where your business may be overspending compared to competitors. Accessing industry reports or working with consultants can provide valuable insights into typical spending patterns and highlight discrepancies in your cost structure.

By benchmarking expenses, businesses can set realistic targets for cost reductions. Understanding where peers and industry leaders allocate their resources can guide strategic decisions and ensure that your business stays competitive. This approach promotes a culture of continuous improvement and cost-awareness among staff, fostering an organization-wide effort to maximize savings.

2. Embrace Technology and Automation

1. Streamlining Operations with Software Solutions

In today's fast-paced business environment, implementing advanced software solutions can significantly streamline operations. Companies can reduce manual errors and improve efficiency by automating repetitive tasks.

Whether it's through project management tools, customer relationship management (CRM) systems, or accounting software, the right technology can enhance productivity.

Additionally, choosing cloud-based platforms can minimize IT costs while providing scalability as the business grows.

Overall, investing in reliable software solutions can lead to long-term cost savings and improved operational effectiveness.

2. Adopting Remote Work Practices

Embracing remote work can have substantial financial benefits for businesses. By reducing the need for physical office space, companies can lower their overhead costs significantly. This includes expenses related to utilities, maintenance, and office supplies.

Remote work also allows businesses to tap into a global talent pool, potentially finding skilled workers at lower wage levels compared to local hires.

Furthermore, offering flexible work arrangements can boost employee satisfaction and retention, resulting in reduced turnover costs in the long run.

As businesses continue to adapt, remote work is becoming a key strategy for maximizing savings.

3. Utilizing Data Analytics for Informed Decision-Making

Data analytics enables businesses to understand their spending patterns and identify areas for potential savings. By leveraging analytics, companies can make more informed and strategic decisions regarding resource allocation.

Through continuous monitoring of financial metrics, businesses can quickly spot inefficiencies and take corrective actions before they escalate.

Moreover, data-driven insights can guide negotiations with suppliers, leading to better pricing and contract terms.

Incorporating analytics not only aids in cutting costs but also supports overall business growth by enhancing strategic focus.

4. Fostering a Cost-Conscious Company Culture

Creating a culture that emphasizes cost savings can lead to widespread improvements in how a business operates. Encouraging employees to recognize and report unnecessary expenses fosters accountability and increases awareness among team members.

Incentivizing cost-saving ideas can also stimulate innovation, leading to additional methods and strategies for reducing overhead.

Regular training sessions on financial literacy can empower employees to make better financial decisions in their respective roles.

Ultimately, a collective effort towards cost consciousness can result in substantial savings for the organization as a whole.

3. Negotiate with Suppliers

Understanding the Importance of Supplier Negotiation

Negotiating with suppliers is a crucial aspect of maintaining a profitable business. Effective negotiation can significantly reduce costs, allowing for increased margins or reinvestment into other areas of the business. Suppliers are often willing to offer discounts or better terms to secure a long-term relationship.

Getting to know your suppliers can lead to more favorable contract terms. A reliable supplier relationship built on trust can be mutually beneficial, reducing conflicts and fostering collaboration.

When approaching negotiations, it's essential to prepare thoroughly. Understanding market pricing and having a clear idea of your budget can empower you to make informed decisions during discussions.

Techniques for Successful Negotiations

Utilizing effective negotiation techniques can make a considerable difference in achieving cost savings. Establishing clear objectives before entering negotiations ensures that both parties are aware of what is needed and expected. Employ tactics such as open-ended questions to uncover hidden costs and opportunities for savings.

Creating a win-win situation is vital. Aim to identify areas that benefit both parties, as this fosters goodwill and can lead to future negotiations yielding even better terms.

It is also important to stay flexible during negotiations. Be prepared to adapt your approach based on the supplier's responses and the dynamics of the conversation.

Building Long-term Relationships with Suppliers

Long-term relationships with suppliers can lead to additional cost savings and benefits. By establishing trust and rapport, businesses may find suppliers willing to offer discounts or improved services over time. A reliable partner can provide more than just products; they can offer valuable insights into market trends and innovations.

Regular communication with suppliers is essential for nurturing these relationships. Keeping an open line of dialogue can help address any issues that arise and allows for discussions about potential cost-saving strategies.

Incorporate feedback into your supplier relationships. Inform suppliers about your satisfaction with their services and discuss opportunities for improvement, which can often lead to mutually beneficial adjustments.

Leveraging Technology in Negotiations

In today's digital age, leveraging technology during negotiations can enhance efficiency and effectiveness. Various software tools are available that allow businesses to analyze supplier proposals and compare them with market standards.

Data analytics can also provide insights into purchasing patterns, helping identify potential areas for negotiation. Using technology to track spending can help businesses pinpoint which suppliers are underperforming or where cost savings can be achieved.

Furthermore, online negotiation platforms can streamline the process by allowing businesses to engage multiple suppliers simultaneously. This not only fosters competition but can also lead to better pricing and terms.

4. Implement Energy Efficiency Practices

Understanding the Importance of Energy Efficiency

Energy efficiency is a crucial aspect of modern business practices. By optimizing energy use, businesses can significantly reduce their operational costs. This not only benefits the finances of the company but also contributes positively to the environment.

Many businesses overlook the potential savings that can be achieved through energy efficiency. Investing in energy-efficient technologies and practices can lead to immediate and long-term financial benefits. Moreover, adopting these practices can enhance a company's reputation among eco-conscious consumers.

Incorporating energy efficiency into business strategies is not just about cutting costs; it's about sustainability. Businesses that prioritize energy efficiency are better equipped to thrive in an increasingly competitive market.

Identifying Areas for Improvement

To implement energy efficiency practices, businesses first need to conduct a thorough energy audit. This audit helps identify areas where energy consumption can be reduced. Understanding and analyzing energy usage is the first step in developing effective strategies.

Common areas for improvement include lighting, heating, and cooling systems. Upgrading to LED lighting or improving insulation can lead to substantial energy savings. Businesses should also consider investing in smart technologies that monitor and optimize energy use in real-time.

Not only should businesses focus on fixed infrastructure, but they must also include employee habits in their energy efficiency strategies. Training staff on energy-saving practices can create a more conscientious workplace.

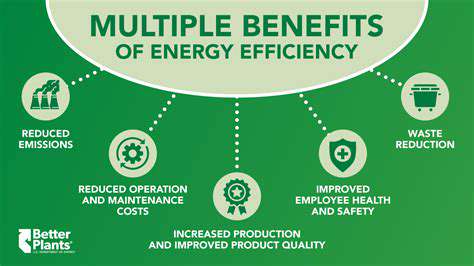

Benefits of Energy Efficiency Initiatives

Implementing energy efficiency practices results in financial savings, but the benefits extend beyond just cost reduction. Businesses often experience improved employee satisfaction and productivity when environments are optimized for energy use.

Energy efficiency initiatives can also increase a company's resilience. By lowering dependency on traditional energy sources, businesses are less vulnerable to fluctuations in energy prices, leading to more stable financial planning.

Additionally, showcasing commitment to sustainability can lead to improved public relations and new business opportunities. Customers increasingly prefer to support businesses that are environmentally responsible. Ultimately, energy efficiency not only contributes to savings but also aligns with a broader commitment to sustainability and corporate ethics.

5. Encourage a Cost-Conscious Company Culture

Understanding the Importance of Cost-Consciousness

Creating a cost-conscious culture within a company is essential for long-term financial success. When employees recognize the significance of managing costs, they become more mindful about their spending and resource allocation. This awareness helps them make informed decisions that contribute to the overall financial health of the organization.

A cost-conscious culture fosters an environment where cost savings are prioritized. It encourages employees to seek alternatives and implement efficiencies in their daily tasks. This mindset not only reduces unnecessary expenses but also promotes creativity and innovation in problem-solving.

Moreover, cost consciousness can lead to improved productivity. When employees are encouraged to think critically about costs, they often find more efficient ways to execute their roles, resulting in smoother operations and better output. This ripple effect can positively impact team morale as well.

Ultimately, a culture that values cost-saving measures equips employees with the mindset and tools necessary to contribute positively to the company's bottom line, making it a key strategy for business sustainability.

Training and Empowering Employees

To develop a cost-conscious culture, companies must invest in training programs that educate employees on the importance of cost management. Workshops, seminars, and regular training sessions can provide team members with insights into best financial practices, allowing them to take ownership of their spending habits.

Furthermore, empowering employees with the authority to make cost-saving decisions enhances their commitment to the organization’s financial goals. When individuals see that their suggestions and contributions can directly impact the company’s expenses, they are more likely to actively seek out ways to save costs.

Involving employees in discussions about budgeting and financial planning can also yield innovative ideas and approaches to reducing costs. Regularly soliciting feedback from staff about how to minimize expenses encourages a collective responsibility for the financial well-being of the company.

Ultimately, training and empowerment go hand in hand. An educated workforce that feels valued and trusted to make financial decisions will contribute significantly to a cost-conscious culture.

Incentives for Cost-Saving Initiatives

Implementing an incentive program can be a powerful way to encourage cost-saving behavior among employees. Recognizing and rewarding team members for their contributions to cost reduction can motivate others to follow suit. This could take the form of monetary bonuses, additional time off, or public recognition within the company.

Additionally, establishing competitive challenges—where teams or departments compete to identify the most innovative cost-saving measures—can instill a sense of camaraderie while promoting creative thinking. This approach not only increases engagement but also fosters a healthy competition that drives results.

To further reinforce the importance of cost-saving measures, companies should regularly share success stories related to cost reductions. Highlighting the impact of these initiatives can inspire employees to contribute their own ideas and show them that their efforts can lead to meaningful change.

By providing both individual and team-based incentives, organizations can cultivate a culture where cost consciousness is recognized and celebrated, thus encouraging continuous improvement in financial practices.

Establishing Clear Communication Channels

Effective communication is critical to fostering a cost-conscious culture. Establishing clear channels for discussing cost-related issues ensures that employees feel comfortable expressing their concerns or suggesting improvements. Regular meetings, newsletters, or intranet forums can serve as platforms for facilitating this dialogue.

Additionally, leadership should articulate the company’s financial goals and cost-saving initiatives transparently. Providing updates on how the organization is performing in terms of managing costs can keep employees informed and engaged. When individuals understand how their work contributes to the bigger picture, they are more motivated to adopt a cost-conscious mindset.

Encouraging open feedback allows for the sharing of insights and ideas that can further enhance cost-saving efforts. Employees often have valuable perspectives on inefficiencies or redundancies that might not be visible at higher management levels. Creating a feedback loop empowers staff to take part in the decision-making process regarding financial practices.

Ultimately, establishing clear communication channels reinforces the idea that everyone has a role to play in maximizing cost savings, thus ensuring that the commitment to a cost-conscious culture is shared across all levels of the organization.

6. Regularly Review Financial Performance

Importance of Financial Review

Regularly reviewing financial performance is essential for any business aiming to maximize cost savings. It allows business owners and managers to understand the financial health of the company and identify areas where expenses can be reduced. This proactive approach to financial management can lead to better forecasting and planning.

Additionally, a thorough financial review helps to identify trends over time, enabling the business to respond swiftly to changing market conditions. It also highlights areas of overspending or inefficiencies that might otherwise go unnoticed, providing valuable insights that can drive cost-saving initiatives.

With a regular review schedule, businesses can set benchmarks and evaluate performances against these targets. This practice not only contributes to a deeper understanding of financial dynamics but also facilitates more informed decision-making at all levels of the organization.

Ultimately, the importance of financial reviews extends beyond cost savings; it enhances overall operational efficiency and strategic planning across the business.

Methods for Conducting Financial Reviews

There are various methods that businesses can utilize to conduct effective financial reviews. One common approach is through the use of financial statements, such as income statements, balance sheets, and cash flow statements. Analyzing these documents allows businesses to gauge profitability and assess their financial position at a glance.

Another effective method is engaging in variance analysis, which compares budgeted figures to actuals. This technique highlights discrepancies and helps businesses understand the reasons behind any variances, guiding future budgeting and forecasting efforts.

Implementing key performance indicators (KPIs) is also beneficial. By setting measurable KPIs, businesses can track progress towards financial goals, facilitating quicker adjustments to strategies when necessary. Regularly monitoring these indicators can provide a continuous feedback loop for financial performance.

Moreover, utilizing software tools for accounting and finance can streamline the review process, providing real-time data analysis and visualizations that make it easier to spot trends and areas for improvement.

Engaging Stakeholders in Financial Reviews

Involving key stakeholders in financial reviews can enhance the credibility and effectiveness of the process. Employees from various departments can offer insights into operational aspects that may be driving costs, leading to more comprehensive discussions around financial performance.

Moreover, involving financial advisors or consultants can bring an outside perspective that could uncover blind spots that internal teams may overlook. These professionals can provide expert advice on best practices for cost savings and financial optimization.

Regularly communicating the findings of financial reviews to all relevant parties fosters a culture of transparency and accountability. By keeping stakeholders informed, businesses encourage collaboration in identifying potential cost-saving measures.

Lastly, creating a feedback loop where employees are encouraged to propose cost-saving ideas can further engage the workforce. This participatory approach not only strengthens team morale but often yields innovative solutions that can significantly impact the company’s bottom line.

- Maximizing Space and Functionality with Multi Functional Pieces

- Mindfulness in Design: Cultivating Awareness Through Thoughtful Creativity

- Transform Your Space with Modular Wooden Furniture: Tips and Trends

- Making Eco Friendly Choices: A Guide to Sustainable Living

- Top tips for buying second hand wooden furniture

- Sustainable Furniture Source: A Guide to Eco Friendly Choices

- How to choose eco friendly wood for sustainable furniture

- Maximizing Workplace Efficiency Through Enhanced Flexibility Strategies

- The Ultimate Guide to Designing a Productive Work Area

- Why Customers Are Choosing Niche Brands in Today's Marketplace

- Evolution of the Woodworking Industry: From Craftsmanship to High Tech Solutions

- How to create a cozy bedroom with wooden furniture