IA pour l'automatisation de la réconciliation des factures

Consommateur de temps et sujet aux erreurs

La rapprochement manuel des factures, le processus de vérification des factures par rapport aux bons de commande et autres documents justificatifs, est une tâche longue qui entraîne souvent des erreurs. Ce processus nécessite généralement un effort manuel important, comprenant la saisie de données, la comparaison et la vérification.

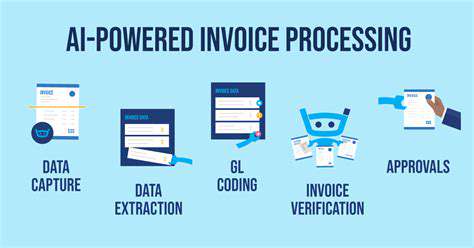

Présentation de l'automatisation des factures grâce à l'IA

Optimisation du traitement des factures avec l'IA

L'automatisation des factures basée sur l'IA optimise considérablement le flux de traitement des factures. Au lieu de saisir manuellement les données des factures papier

Au-delà de la Correspondance : L'IA pour une Précision et une Efficacité Améliorées

Au-delà de la Correspondance Initiale : Affiner les Recommandations Basées sur l'IA

More about IA pour l'automatisation de la réconciliation des factures

- Les meilleures solutions pour les petits espaces utilisant des designs de meubles en bois

- Comment créer un look sophistiqué avec des meubles en bois foncé

- Le guide ultime pour choisir des meubles de jardin en bois

- Comment intégrer des meubles en bois dans votre maison minimaliste

- Comment entretenir et conserver vos meubles en bois pendant des années

- Comment assortir les meubles en bois à la lumière naturelle de votre maison

- Comment combiner des meubles en bois avec des accessoires vintage

- Meubles en bois les plus performants pour améliorer votre espace de vie

- L'impact de l'IA sur les alertes et notifications automatisées de la chaîne d'approvisionnement

- Visibilité de la chaîne d'approvisionnement pour une meilleure précision des stocks et une meilleure gestion des stocks

- L'avenir de la gestion de la chaîne d'approvisionnement : propulsé par les jumeaux numériques

- Mise en œuvre de la robotique pour une meilleure productivité et efficacité